| Scott Danger is a Certified Public Accountant with over 10 years of experience.

His column, Moneywise, is a regular feature on the website

Mommysavers.com. Scott is the father of two-year-old Sydney and lives in

Minnesota. His column can be viewed by clicking

here. |

Even a CPA thinks this topic is boring. So why did I choose this

topic to discuss? Because unless you have an unlimited supply of

cash and savings, it is probably something you should think about

and consider. Most people think of a budget as a set of rules that

tell you where you can, and more often canít, spend your money. I

try to think of a budget as a tool -- something you use to achieve a

goal. Maybe your goal is a special vacation or a new house. Maybe itís

saving for your kids college education or your retirement. Or maybe

it is much more basic, such as paying your monthly bills or paying

off your credit card debt. Whatever your goal may be, a budget can

help you achieve it.

To develop a budget, you need to know

what you make and where you are spending your money. The best way to

accomplish this is to track every dollar your household earns and

spends for one month. This is probably not as difficult as it

sounds. Your check register already tracks any checks you write and

deposits you make. And, every time you use your credit card, you get

a receipt. What you are left with is the cash you spend. For this,

you need to keep a log noting every dollar of cash you spend. To develop a budget, you need to know

what you make and where you are spending your money. The best way to

accomplish this is to track every dollar your household earns and

spends for one month. This is probably not as difficult as it

sounds. Your check register already tracks any checks you write and

deposits you make. And, every time you use your credit card, you get

a receipt. What you are left with is the cash you spend. For this,

you need to keep a log noting every dollar of cash you spend.

At the end of the month, summarize

all of your transactions and develop your budget. To do this, you

need to assign categories to each expense. Each household will have

slightly different categories, but a typical one could be as follows:

| INCOME: |

EXPENSES: |

| Wages |

Mortgage |

| Other |

Insurance |

| |

Utilities |

| |

Car payments |

| |

Food |

| |

Transportation |

| |

Clothing |

| |

Contributions |

| |

Childcare |

| |

Recreation and

Entertainment |

| |

Medical and Dental |

| |

Home maintenance |

| |

Vacations |

| |

Other |

Now it is time to develop a budget. I

like examples, so letís use a fictional family. Weíll call them

the Jonesí. Tom is a carpenter. His wife Judy works part-time at a

local department store. They have two kids, Tom Jr. who is 6 and

little Susie who is 3. They live in a modest house in the suburbs

and Tom is saving for their retirement with his companyís 401k

plan. They know saving is important but never seem to have any

additional money left at the end of the month to save. They feel if they

had a budget they could better control their spending and be able to

save. They have three main things they want to save for: an

emergency fund, college for the kids, and an annual family vacation.

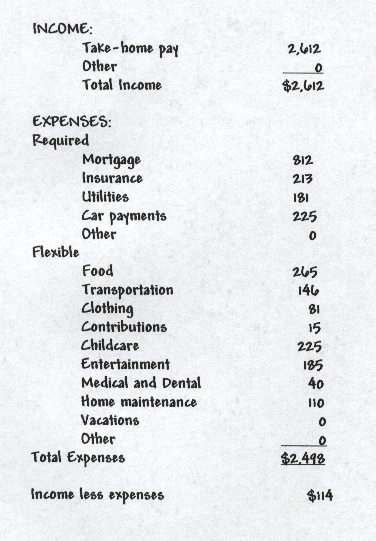

Both Tom and Judy kept track of all

their expenses last month. It wasnít easy, but now they have a

snapshot of where their money is going. They assigned categories to

every expense and then totaled each category. Below is what they

found:

Now that we know where they spend

their money, we can develop their household budget. To do this, we

need to decide if this was a "typical" month. For Tom and

Judy, it was. Their paychecks were average as were their other bills

for the month. Remember, their goal was to be able to start saving

for an emergency fund, college for the kids and an annual vacation.

Last month, they had $110 to put away. Thatís a start, but it wonít

get them far.

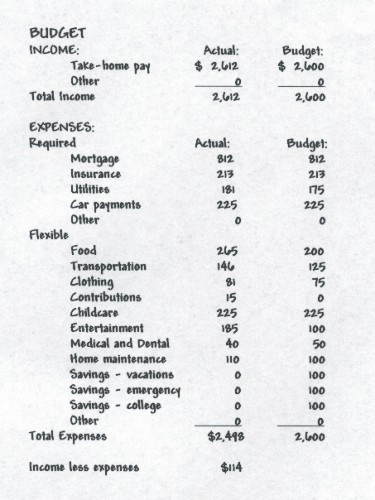

To develop the Jonesí budget, we

will use their actual month as a starting point. From there, we will

adjust their spending in certain categories and try to achieve their

goal of saving. Their required expenses do not change month-to-month

so they were the easiest to budget. On the other hand, their

flexible expenses could be adjusted. The food budget was set at a

lower amount than what they have actually been spending. Food is an

area that many families, with proper planning, can cut expenses. By

shopping sales, using coupons and making more meals from scratch, it

is a fairly easy area to save money. Entertainment is another area

where many families can cut back and where the Jonesí found they

could reduce their spending. This doesnít mean cutting back on

family activities or having fun. It just means being a little

pickier on where you choose to spend your entertainment dollars and

also making use of the free activities communities offer. By making

these changes in how they are spending their money, they can now

achieve their goals of saving for an emergency fund, their childrenís

college fund and an annual family vacation. This is what their

budget now looks like:

Tom and Judy have a budget. Now how

do they stick to it? The key is discipline. It is always knowing how

much money you have remaining in your budget and only spending if

your budget allows. There are many good computer programs available

which can help track your expenses and budget. One may have come

pre-loaded on your personal computer. You can also use a notebook

with one page for each category. At the top of the page, write your

starting budget amount. Then, as you spend money throughout the

month, write down what you purchased and subtract it from your

budget. This will give you a running total of what remains in your

budget. Another good way is by using envelopes and cash. Have an

envelope for each category. You can skip the categories that you pay

by check and that donít change month to month, such as your

mortgage and insurance. At the beginning of the month, put cash in

each envelope totaling the amount of the budget. Then, use this cash

to pay your expenses throughout the month. Whatever cash is in the

envelope is what you have left for the month. Itís a great

reminder as to how much you have remaining. Just remember to take

cash out if you need to charge or write a check for an expense.

Whatever way you choose to make your

budget work, the key is to stick to it and to always know what

remains in your budget. Good communication is key. Budgeting is not

easy, and I guarantee there are things more fun, but if you have

specific financial goals, itís important. Give budgeting a try.

Fine-tune it as you go, and good luck!

--End--

|