When Ben Franklin died in 1790 he left $5,000 each to the cities of Boston and Philadelphia. Each city was to create a fund that would last for 200 years. The needy could borrow from the fund at 5 percent interest. After 100 years each city could withdraw $500,000 from the fund, leaving the rest to work for the next 100 years. Why did Ben do it? To help people understand the importance of compound interest.

What is compound interest? It’s interest earning interest. For example, suppose you saved and banked $100 a year ago. It earned $2 in interest last year. This year you’ll be earning interest on $102 (original savings plus the interest earned). That might not seem like much, but understanding that simple fact can have a major impact on your financial success.

Why is compound interest important to you? Because it can turn just a few dollars today into big money over the course of your lifetime. Let’s look at the ten facts you need to know about compound interest.

Anyone can benefit from compound interest. No need to be a Wall St. wizard or Harvard MBA. Almost any investment will earn compound interest if you leave earnings in the account.

Compound interest is a double edged sword. It’s great if you’re routinely saving money. It can be cruel if you’re borrowing money.

You want savings to compound as often as possible. It’s better if you compound quarterly rather than annually when you’re saving money. If you’re borrowing, just the opposite applies.

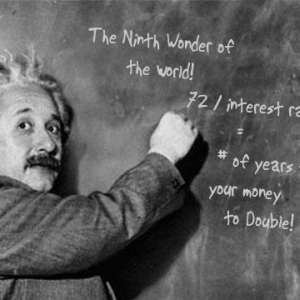

Time is on your side. The longer money compounds the faster it grows. Money growing at 6% per year will double in about 12 years. But it will be worth 4 times as much in 24 years!

Time is not on your side. Credit cards and other open-ended accounts use compound interest against you. That’s why ‘minimum payments’ are likely to keep you in debt forever.

Don’t let today’s low interest rates discourage you. It’s true that banks aren’t paying much on savings accounts. But many mutual funds average a higher return and have very low minimums and no sales charges. If you can’t apply a few dollars to savings, most debts (think home or credit cards) will allow you to add any amount to your payment.

It adds up faster than you think. If you were to save $5 per month, earn 5% interest compounded each month and do that continually for 10 years you’d have put $600 into savings. But the account would be worth $776. And, even if you didn’t add a single dime, it would be worth over $1,500 in another 15 years.

Compound interest can free you from credit cards. Suppose your interest rate is 14 percent and you add just $5 per month to your payment. In 10 years you’ll avoid $1,315 in payments.

You don’t need to be rich to get compound interest to work for you. The principal works the same whether you invested $100 or $100 million. The millionaire may have more investment options, but even the poorest among us can use compound interest to reduce the amount that we pay credit card companies and payday lenders.

Compound interest requires you to sacrifice today to reap a benefit tomorrow. It’s true that you’ll need to do something to save a few dollars today. But, it’s certain that the future reward will be greater than the sacrifice.

What’s the bottom line for consumers? Often the difference between financial comfort and poverty isn’t that great. Saving a few dollars a week might not seem like much. but if done consistently it could make a big difference in your financial future.